Panorama blog

Because understanding is also a way to invest better. Explore ideas, trends, and market cues to make thoughtful decisions.

Showing 15

de 176

result(s)

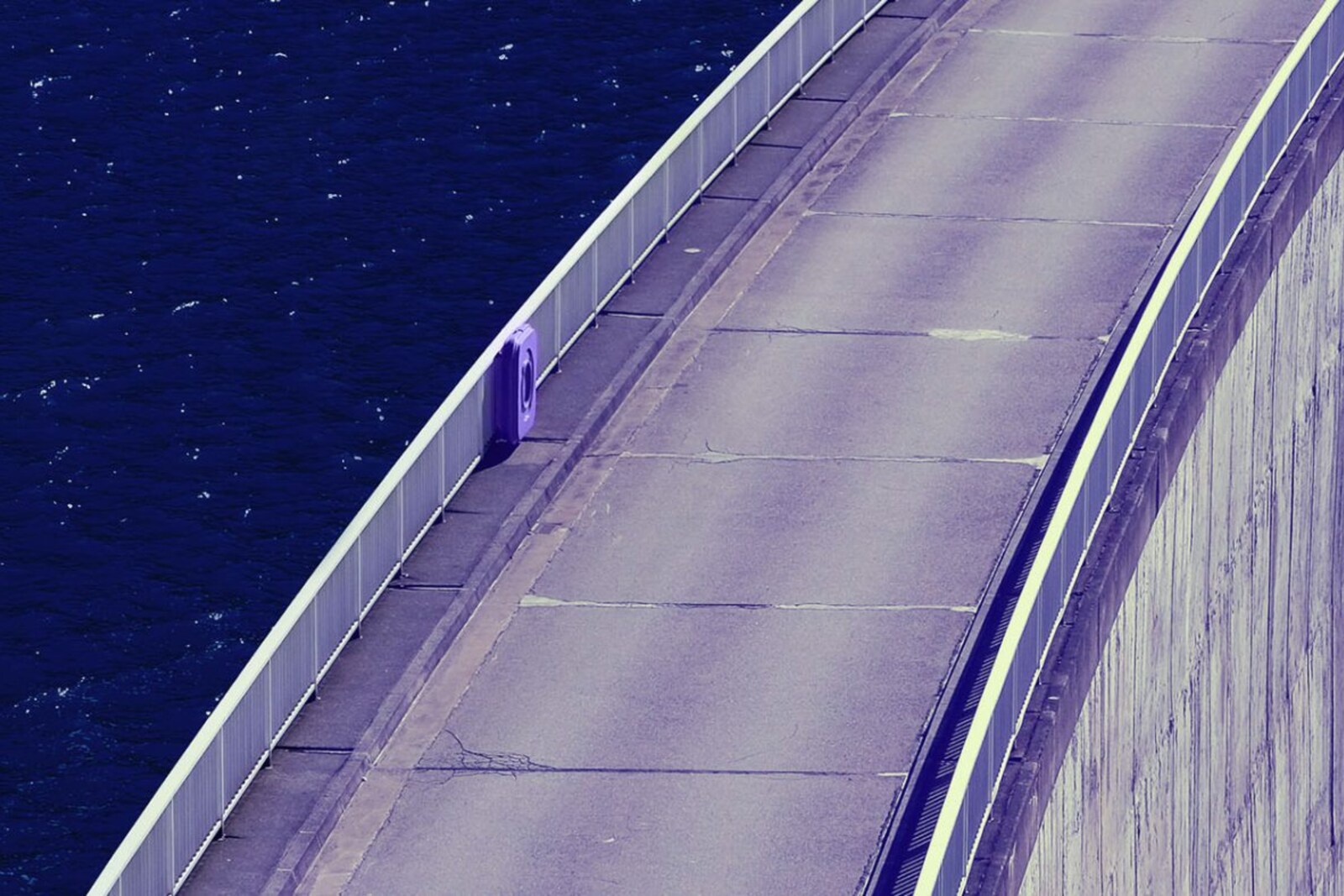

Investing in water: a profitable trend that can also benefit mankind

The efficient management of water, a valuable raw material, has become a profitable sector for investors. Technology and innovation are key to reducing water consumption and recycling it.

What if we used black holes as a source of energy?

This is a question that theoretical physicists have been asking for some time, and the findings from a new study show that, theoretically, it would be possible to use black holes as galactic power banks.

This is how we will eat in 30 years: seaweed, vegetable meat and insects

A quinoa burger, some seaweed spaghetti or cookies with cricket flour. Population pressure and climate change are precipitating a food revolution in the coming years: our diet will not be the same as today.

The future of work: AI and no offices

We are immersed in an unprecedented labor revolution. Most jobs of the future do not exist today. This raises important questions: What will offices be like by 2030? Will remote work continue?

AI and agriculture, smart farming arrives to boost sustainable production

The Earth will be home to a staggering 10 billion human beings by 2050. One of the biggest challenges we face is how we are going to feed the entire planet sustainably. This is where 'smart farming' comes into play.

Critical raw materials for the energy transition: a short- and long-term challenge

The new energy system, harnessing clean and renewable energies, has completely reshaped the market for certain commodities. It is estimated that demand for five of the materials considered critical to ensure the energy transition could increase up to sevenfold by 2050.

Save on energy to invest in our planet

From the most elementary levels, light is at the origin of life itself. Its exploration has led to the development of promising alternative energy sources, life-saving medical breakthroughs, and numerous other innovations that have shaped our understanding of the universe.

Energy storage: the new philosopher's stone

With more certainty than ever, sustainable investment is the future and 2023 looks set to be the year in which renewable energies will begin their unstoppable rise around the world.

Life in 2045: a preview of cities in 20 years' time

20 years from now, more than 6 billion people will live in cities, primarily in Africa and Asia. This growing urban population requires solutions to make these cities organized, sustainable and equitable.

Sustainable investment vs. impact investment

Although the economic, social and environmental goals of both types of investing are the same and complement each other, their processes and applications differ. While the former emphasizes measurement, the latter focuses more on maximizing a positive impact.

ESG investments, a market that already totals $2.5 billion

Sustainable investment is an alternative that allows investors to earn money and fight against climate change and social inequality. At the end of 2022, the market for investment with ESG criteria amounted to $2.5 billion. And it continues to grow.

EU sustainable finance action plan: rules to change investment practices

Having committed to reducing its greenhouse gas emissions by 55 % for 2030, the European Union has been rolling out for several years now its sustainable finance action in installments. Taking them one by one, let's have a closer look at how these 9 regulations are set to change the market.

Micromobility and public transportation gaining momentum

16% of the global urban population already gets around using bicycles and scooters. By 2030, the market for this new and sustainable micromobility will be worth $440 billion.

Managing your money: How to create a budget?

Investment planning always starts with a budget. By organizing your income and expenses over time, you can better control your personal finances, save more, and manage payments more effectively. There are guidelines to help you refine your budget.

Cybersecurity, the other big trend standing in the shadow of AI

The big bet on the artificial intelligence (AI) revolution often overshadows another key technology trend for digital transformation: cybersecurity. Besides protecting digital assets, experts stress the need to build an organizational culture that is risk-aware and prepared to respond to growing threats.