The new energy system, harnessing clean and renewable energies, has completely reshaped the market for certain commodities. It is estimated that the demand for five of the materials considered critical to ensure the energy transition - lithium, cobalt, nickel, copper and neodymium - could increase up to seven times by 2050.

The solutions to avoid the shortage of the so-called critical raw materials needed to manufacture everything from electric cars to solar panels include strengthening cooperation between states and strengthening extraction systems. But it is also important to improve innovation and recycling to reduce demand, the environmental and social impact of their extractions and the dependency generated on the producing countries.

Finding new ways to optimize and reuse these materials is essential to achieving zero emissions targets and putting a stop to climate change.

Net-zero materials

To get the world to say goodbye to fossil fuels, we need to ensure energy production through renewable sources. To do this, we need technology such as electric cars, solar panels or wind farms. And, to create this technology, there are essential materials whose demand is shooting up as investment in renewable energies grows.

To manufacture an electric car, six times more minerals are needed than to create a conventional car. The operation of an onshore wind farm, on the other hand, requires nine times more mineral resources than a gas plant. Consequently, and according to the International Energy Agency (IEA), the average amount of minerals required by each new power generation unit has increased by 50% since 2010.

The Energy Technology Perspectives 2023 report from the IEA analyzes the challenges and issues faced by the technology and clean energy supply chains in the coming years. And one of its conclusions is that the demand for five materials considered critical by the European Commission, the United States U.S. and other countries and bodies might increase between 1.5 and 7 times in a scenario of net-zero emissions by 2050.

These are lithium, cobalt, nickel, copper and neodymium. Materials that are primarily found in few countries and are currently mined to a limited extent. For example, it can take more than 10 years from the time a lithium deposit is discovered until it is mined efficiently and continuously.

The future, our best investment

Capitalize on opportunities in a way that is positive, conscientious and committed, with solutions designed for you by our investment experts in your bank in Switzerland.

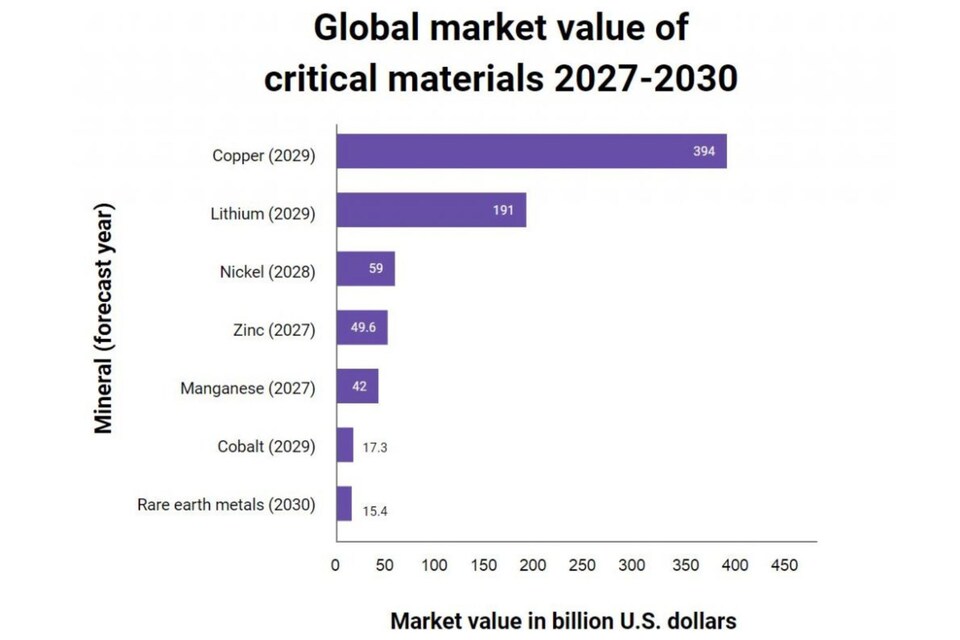

More investment until 2030

According to data from the International Energy Agency, in 2022 investment in projects linked to critical raw materials reached $40 billion, 30% more than the previous year.In the report The net-zero materials transition: Implications for global supply chains, published last July by the consultants McKinsey & Company, experts predict that investment in mining, refining and smelting these minerals will need to increase by between $300 billion and $400 billion to secure their supply beyond 2030. “It will be necessary to increase working capacity by between 300,000 and 600,000 mining professionals", the report explains. In the lithium industry alone, the necessary investment exceeds $100 billion.

As the FIA (global trade organization for the futures markets) acknowledges, nickel - obtained by mining and recycling - has maintained continued growth and good long-term prospects due to its importance in the electronics and battery industry for electric vehicles. Experts are talking about the volatility of this metal. In fact, in March 2022, when the war began in Ukraine, its price skyrocketed due to the scarcity caused by the war - Russia is the world's third biggest producer - and one year later it fell due to the increase in production, especially in countries such as Indonesia, the number one producer worldwide.

Another material whose evolution is closely linked to the manufacture of electric vehicles, smartphones, tablets and laptops is lithium, a market that is also volatile, but where “constant returns” can be obtained, according to Forbes specialists. Despite the fluctuations, prices seem to have stabilized since April this year. In 2022, Australia topped the list of producing countries in this area, followed by Chile and China. In Latin America (Argentina, Chile and Bolivia), where more than half of the planet's lithium is found, a “window of opportunity” has been opened for investment to develop the industry, contribute added value to the product and generate other business linked to its mining.

Solutions to avoid a bottleneck

The main consequence of the gap between high demand and low mining rates - coupled with the fact that there are no unlimited materials - is a rise (or volatility) in renewable energy prices and the consequent slowdown in the energy transition. And this is despite the fact that global investment in renewable energies reached record figures in 2022. One example, according to the IEA, is that investment in solar power will exceed oil production this year for the first time.

The solutions the IEA points out in its report includes investing in innovation to improve sustainability and promote recycling. Specifically, the Council of the European Union recently positioned itself in favor of recycling and reusing critical raw materials by endorsing the regulation that guarantees its safe and sustainable supply. As it depends on the supply of third countries, the EU governing body is committed to the national processing and recycling of these materials.