The population is growing and needs water, food production is growing and needs water, industry is growing and needs water… The efficient management of this valuable raw material has become an interesting sector for investors. Technology and innovation are key to reducing water consumption and recycling it.

Water is a valuable resource - and it will become even more valuable in the coming decades. In 2030, the world will face a water deficit of 40% based on expected consumption and current usage. In 2025, 1.8 billion people will live in regions with absolute water shortages. These forecasts, published by the World Bank, reflect the complex situation the world faces with regard to the use of the most basic raw material: water.

If you look at it over an even longer period, the data is not more positive. By 2050, the world's population is expected to exceed 10 billion people, which means we need to produce 56% more food. Taking into account that agriculture currently accounts for 70% of total fresh water consumption, its demand will rise by 19%. But that's not all: this population rise will result in an increase in domestic water demand of 130%. Industry's demand for water will also rise by 140%.

This considerable demand is compounded by the fact that of the 1,693 total aquifers examined worldwide, there was a significant decline between 2000 and 2022. A combination of factors that present investment in water as an alternative. An alternative to tackle or minimize future scarcity problems, and also an interesting and unusual investment opportunity.

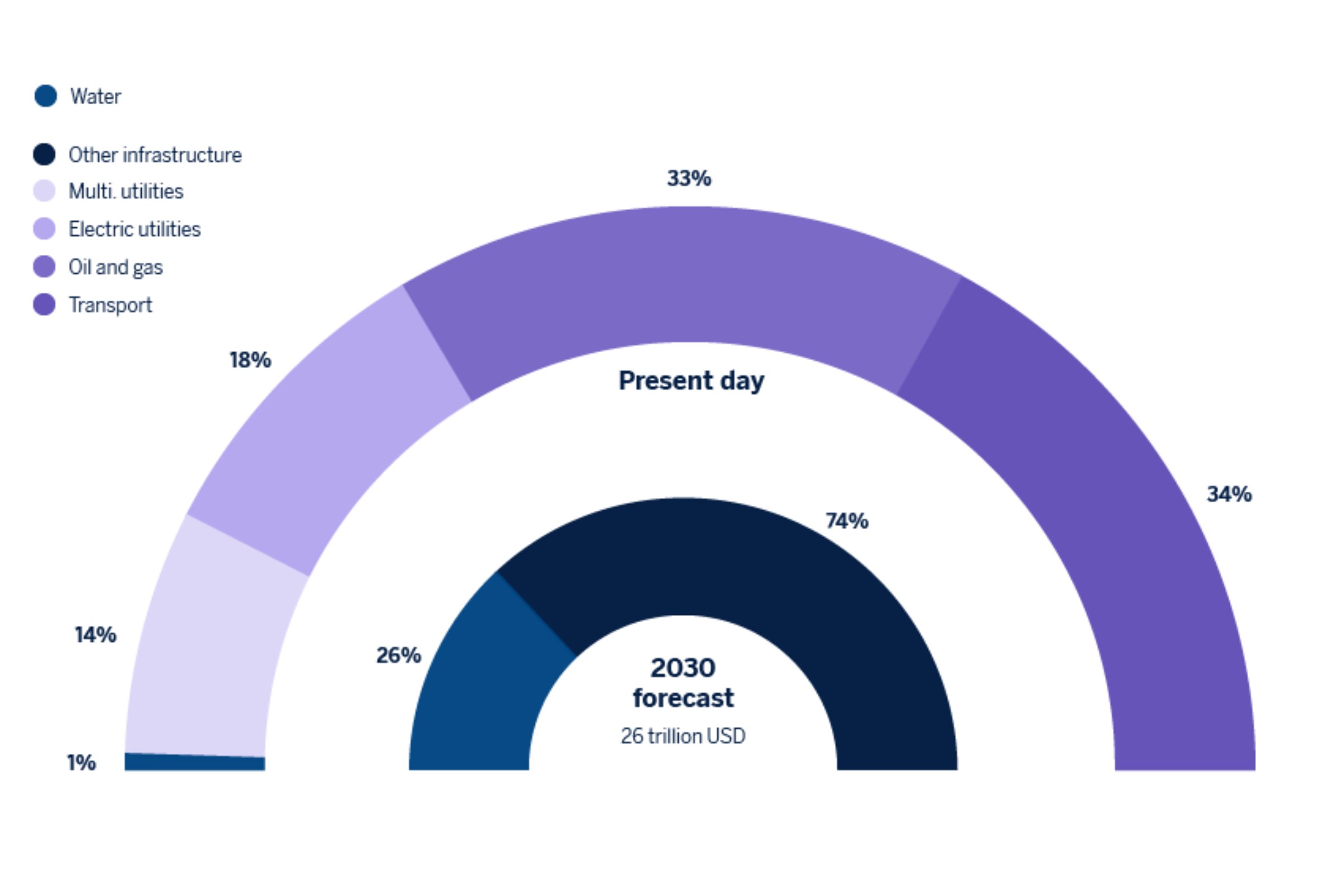

Investment in hydraulic infrastructure

What does investing in water involve?

According to a report by Goldman Sachs, water consumption is expected to increase by more than 1% per year in the next 30 years, driven mainly by economic activity. Although only 12% of the world's water consumption is allocated to households, the remaining 88% is used in agriculture and industry. In view of the need for more efficient water management, companies are seeking advanced technologies to reduce consumption and recycle water. This is where investment opportunities arise, in companies that are applying technology and innovation to the use of water to be able to address future consumption.

Many companies, both large and small, are committed to innovation in the use of water. In Switzerland, companies like Bausec are applying sensor technology to detect water leaks and avoid waste. While others such as PriWaTec, AQUA GONTIER or Macauda Spültechnik are focused on improving the treatment and quality of water with a view to reducing consumption and protecting the environment.

Investment funds, ETFs, blue bonds…

Investing in water can be done in very different ways: with investment funds, ETFs (exchange-traded funds), stocks or blue bonds. Some of the most well-known funds have a similar approach to investing in listed companies, with a focus on treatment and improved water management.

Blue bonds are debt issue instruments designed to protect the oceans and marine ecosystems by preserving them. These bonds are used to finance projects that establish infrastructures for water treatment and management, as well as to implement measures to preserve marine biodiversity.

Switzerland, a winning formula

Switzerland has the perfect recipe to stay on the podium as a financial capital - and to go further. The tradition, innovation and sophistication of its private banking attracts investment.